On the 1st and May 22nd, Huaxing Optoelectronics 11th generation TFT-LCD and AMOLED new display device production line construction project (t6 project) completed the first exposure machine and CF ITO equipment successfully moved in. At the same time, the t7 project was also officially signed on the same day. 2, Reuters Beijing time reported on May 29, South Korea "Electronic Times" said that Apple has decided to use OLED screens in all new iPhone models released next year.

Comments The recent outbreak of demand for small OLED panel sizes has resulted in an increase in the quantity and price of mid-stream manufacturing equipment. Compared to traditional LCD screens, OLED screens have features such as low energy consumption, lighter weight, faster response, and more flexible characteristics, enabling flexible displays. era. In the past, due to the limited technical level, the cost of OLED screens remained high and the penetration rate was low. In recent years, with the continuous improvement of processing technology, the cost of OLED panels has been continuously reduced. At the same time, under the trend of consumption upgrade, major mobile phone manufacturers have successively launched flagship models equipped with comprehensive OLED screens. This time, Apple may determine three models of next year. Both are OLED screens (originally at least one model is an LCD screen), which exceeds market expectations and is expected to play an exemplary role for Apple. Other mobile phone brands are rapidly following up. From the supply side, OLEDs are currently able to stabilize volume suppliers. For Samsung, but due to Samsung's tight production capacity, the industry is in short supply. Closely followed domestic manufacturers firmly grasp the opportunities for technological innovation. BOE, China Star Optoelectronics and others have accelerated to catch up in recent years, the domestic OLED market will be from 2016 It only accounts for 3% of the world's total, and will increase to 30% of global capacity in the future. Corresponding to the dramatic increase in capital expenditures of major panel makers in China (increased production lines for production, and an increase in the value of each line), it is expected that the investment amount will increase from the original LCD investment, and the total investment amount will be doubled in 2018-2020. Midstream equipment companies will benefit from the expansion of panel lines and equipment upgrades (value increase) brought by OLED panels. According to statistics, according to statistics, there are also 8 OLED production lines currently under construction in China. According to the estimation of the post-channel module investment of 10%, the production of OLED panel lines in 2018-2021 will be the later model. Group segment equipment brings nearly 20-30 billion yuan of market.

Large-size panel production capacity is continuously transferred to China: The total investment of the 11th-generation TFT-LCD and AMOLED new display device production line construction project of China Star Optoelectronics is 53.8 billion yuan. After completion, it will become the world's highest generation LCD panel production line. It is planned to realize the volume in March 2019 Production. On the whole, whether LCD or OLED is the focus of domestic large-scale production capacity, according to statistics, 8 of the domestic high generation line (over 8.5 generations) will be put into production in recent years, the overall investment of up to 300 billion, is expected to 80% Equipment investment will also have close to 20 billion investment in modular equipment in the next 2-3 years. At present, the domestic module segment equipment manufacturers already have relatively reliable technologies. At the same time, the panel manufacturing and inspection equipment companies have the advantages of rapid response to the market, provision of complete set solutions, and after-sales services, and it is expected that the domestic equipment market share will further increase.

Investment suggestions: 1. After the module equipment field: At present, China's midstream equipment manufacturing enterprises are mainly concentrated in the post-module segment, domestic companies will benefit from the expansion of the panel line, the import substitution rate of domestic equipment, part of the leading module The factory has entered the apple industry chain (Liande, Xin Sanli, and Precision have all become Apple supply chain companies), and in large sizes, domestic manufacturers have also made breakthrough progress. In 2018, the production rate of panel equipment will be Increased to 35% -40%, the focus is recommended after the trail module equipment leading enterprises Zhiyun shares, connected equipment 2, testing equipment: Focus on domestic panel detection leading precision electronic test. In recent years, Precision Electronics has continuously increased its investment in R&D, covering the testing of module sections, cell sections and some Array sections. As the main customer of Jingdi Electronics, BOE’s expansion of its panel line is expected to bring improved performance to Jingdian Electronics.

Risk Warning: The yield rate of OLED production lines is less than expected, and the equipment import substitution rate is lower than expected.

Comments The recent outbreak of demand for small OLED panel sizes has resulted in an increase in the quantity and price of mid-stream manufacturing equipment. Compared to traditional LCD screens, OLED screens have features such as low energy consumption, lighter weight, faster response, and more flexible characteristics, enabling flexible displays. era. In the past, due to the limited technical level, the cost of OLED screens remained high and the penetration rate was low. In recent years, with the continuous improvement of processing technology, the cost of OLED panels has been continuously reduced. At the same time, under the trend of consumption upgrade, major mobile phone manufacturers have successively launched flagship models equipped with comprehensive OLED screens. This time, Apple may determine three models of next year. Both are OLED screens (originally at least one model is an LCD screen), which exceeds market expectations and is expected to play an exemplary role for Apple. Other mobile phone brands are rapidly following up. From the supply side, OLEDs are currently able to stabilize volume suppliers. For Samsung, but due to Samsung's tight production capacity, the industry is in short supply. Closely followed domestic manufacturers firmly grasp the opportunities for technological innovation. BOE, China Star Optoelectronics and others have accelerated to catch up in recent years, the domestic OLED market will be from 2016 It only accounts for 3% of the world's total, and will increase to 30% of global capacity in the future. Corresponding to the dramatic increase in capital expenditures of major panel makers in China (increased production lines for production, and an increase in the value of each line), it is expected that the investment amount will increase from the original LCD investment, and the total investment amount will be doubled in 2018-2020. Midstream equipment companies will benefit from the expansion of panel lines and equipment upgrades (value increase) brought by OLED panels. According to statistics, according to statistics, there are also 8 OLED production lines currently under construction in China. According to the estimation of the post-channel module investment of 10%, the production of OLED panel lines in 2018-2021 will be the later model. Group segment equipment brings nearly 20-30 billion yuan of market.

Large-size panel production capacity is continuously transferred to China: The total investment of the 11th-generation TFT-LCD and AMOLED new display device production line construction project of China Star Optoelectronics is 53.8 billion yuan. After completion, it will become the world's highest generation LCD panel production line. It is planned to realize the volume in March 2019 Production. On the whole, whether LCD or OLED is the focus of domestic large-scale production capacity, according to statistics, 8 of the domestic high generation line (over 8.5 generations) will be put into production in recent years, the overall investment of up to 300 billion, is expected to 80% Equipment investment will also have close to 20 billion investment in modular equipment in the next 2-3 years. At present, the domestic module segment equipment manufacturers already have relatively reliable technologies. At the same time, the panel manufacturing and inspection equipment companies have the advantages of rapid response to the market, provision of complete set solutions, and after-sales services, and it is expected that the domestic equipment market share will further increase.

Investment suggestions: 1. After the module equipment field: At present, China's midstream equipment manufacturing enterprises are mainly concentrated in the post-module segment, domestic companies will benefit from the expansion of the panel line, the import substitution rate of domestic equipment, part of the leading module The factory has entered the apple industry chain (Liande, Xin Sanli, and Precision have all become Apple supply chain companies), and in large sizes, domestic manufacturers have also made breakthrough progress. In 2018, the production rate of panel equipment will be Increased to 35% -40%, the focus is recommended after the trail module equipment leading enterprises Zhiyun shares, connected equipment 2, testing equipment: Focus on domestic panel detection leading precision electronic test. In recent years, Precision Electronics has continuously increased its investment in R&D, covering the testing of module sections, cell sections and some Array sections. As the main customer of Jingdi Electronics, BOE’s expansion of its panel line is expected to bring improved performance to Jingdian Electronics.

Risk Warning: The yield rate of OLED production lines is less than expected, and the equipment import substitution rate is lower than expected.

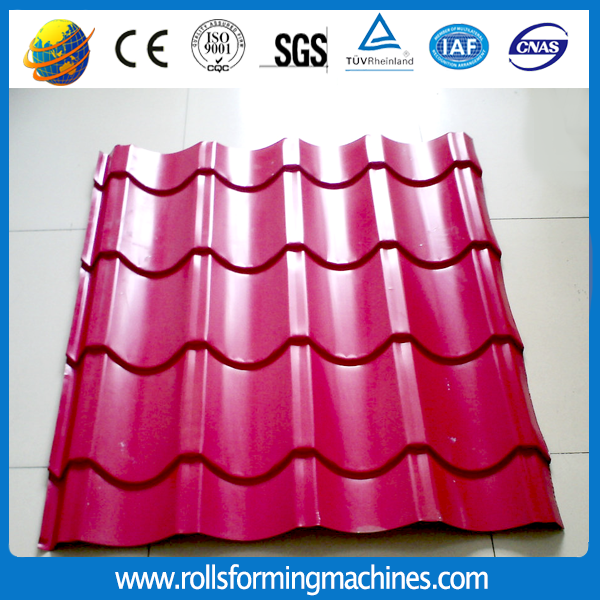

Coil Sheet is also know as steel coil or coil steel.Our company mainly provides pre-painted coil sheet and galvanized coil sheet. Our coil is widely use in building. We also have the matching machine. Such as steel Coil Slitting Line,cold Roll Forming Machine,metal working machine,cut to length and so on.

Coil Sheet

Aluminum Sheet, Aluminum Coil, Galvanized Steel Coil, Color Steel Coil

Zhongtuo Roll Forming Machinery Co., ltd , https://www.rollsformingmachines.com